Seen Tarbi for Financial Technology is permitted by the Saudi Central Bank to test its innovative services under the Regulatory Sandbox environment.

Banks

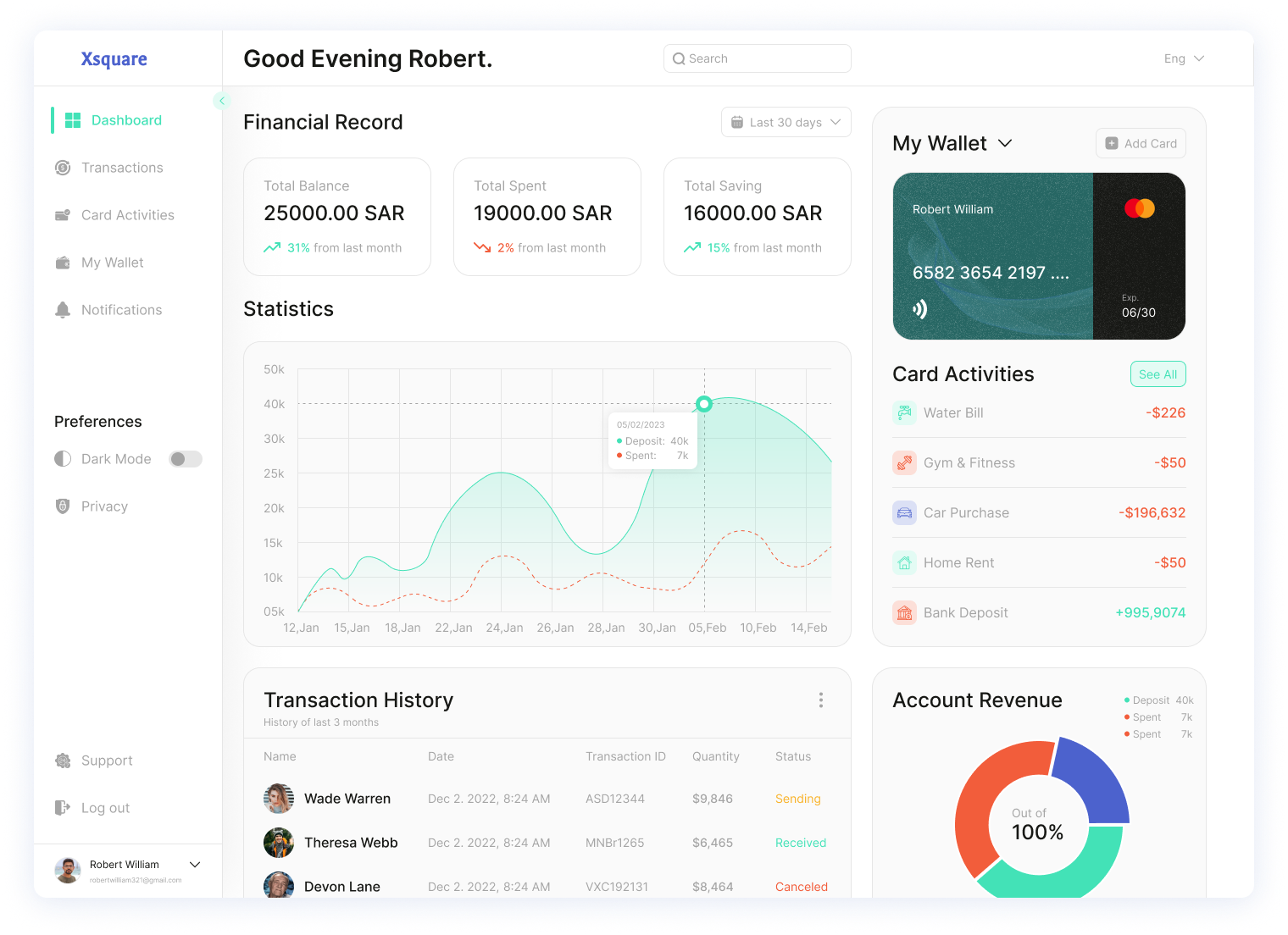

X^2 is the simplest, fastest way for banks to create new revenue streams through account-to-account payments and open banking.

Use Cases

Generate new revenue streams with higher-margin A2A payments

Banks can create new revenue streams with higher margins by offering account-to-account payment propositions to their corporate clients. Banks can choose to white-label Token Payments or use X^2 technology to build their own solution.

Build sophisticated loyalty programmes and offers

By enabling access to seamlessly aggregated transaction and account data from banks in Saudi Arabia, Token Data allows corporate bank customers to build deeply personalised customer experiences, loyalty and value-added programmes. Armed with deeper data, corporate bank customers can even develop prediction capabilities and build value-added programmes.

Create deeper corporate customer relationships

Banks can use X^2 technology to create deeper customer relationships in a disrupted, hyper-interconnected financial ecosystem. For example, banks can enable the efficiencies of multibanking for their corporate customers by providing access to financial data from across bank accounts in a single view, while curating real-time intelligence for accounting and treasury management functions.